Why Make Money?

My Utility of Money Amid a Potential Ballistic IPO

In the rumors of an upcoming IPO with potential to be the largest in history, I oscillate between fear and greed.

Should I sell? Should I hold? Should I buy?

These emotions rattle against one another overwriting any spreadsheet analysis or rational thought.

In the end, this decision will not be based on maximizing for returns, but what Morgan Housel writes “maximizing for how well I sleep at night.”

Regardless, I can’t help to ask the second-order question: What is the point of me making money?

This isn’t some nihilistic question—a view that I’m going to die and the whole world is going to burn so everything will be pointless—but a utilitarian one. Money certainly has utility.

Let’s say the stock goes ballistic.

Cool.

Then what?

If not already, I will buy a house.

Beyond that, what else is there?

Short of what billionaire Sam Zell calls “private jet money”, there are few materialistic things that can drastically improve my life.

Furthermore, if having money’s main purpose is no longer needing to obtain it, the endless pit I can spend money on is savings.

“The trick is viewing every bit of savings as having actively purchased something, even if it doesn’t come with a receipt: You have purchased the ability to do what you want, when you want, with whom you want, for as long as you want. And it is priceless.”

Morgan Housel

The most luxurious thing I can do for myself is to minimize lifestyle inflation and to accumulate the financial security and peace of mind which enables my risk averse self to act on that freedom.

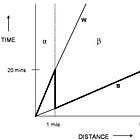

I lengthen my life equivalent of a startup runway.

If I distill that idea into the present, why must I wait for a financial windfall to leverage this freedom, given my current savings and minimal lifestyle costs?

Bill Perkins outlines this idea called Consumption Smoothing in Die with Zero:

Our incomes might vary… but that doesn’t mean our spending should reflect those variations—we would be better off if we evened out those variations… we need to basically transfer money from years of abundance into the leaner years. That’s one use of savings accounts.

In my case, using my savings account is not the act of buying things nor going on lavish vacations, but actually being ok with it not accumulating, which goes against my risk-adverse nature.

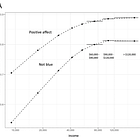

Currently in my prime, free from illness, responsibility, and cynicism, I have great utility of using my money now.

Just like how others in their 20s can use their money and youth to go out, travel, and let their lifestyles inflate (nothing wrong with that! Enjoy it!), I can make risky bets with infinite long-term upside, absolutely work my face off with little distractions, and gather the stories that drive future wisdom and personal memory dividends.

By reframing my present savings as a cushion to act and de-weighting the need to make so much money now, I take steps towards authenticity, conviction, and agency—the very characteristics I’m optimizing for in my 20s.

I also get to loosen the golden handcuffs a bit more.

So here I am, back at square one, still stewing in fear and greed.

Have I made any progress towards a decision?

Not really.

But I have made progress on identifying what truly matters now.

If you’re thinking about breaking golden handcuffs:

If you’re also grappling with the desire for money

If you’re curious on what I’m optimizing for in my 20s: